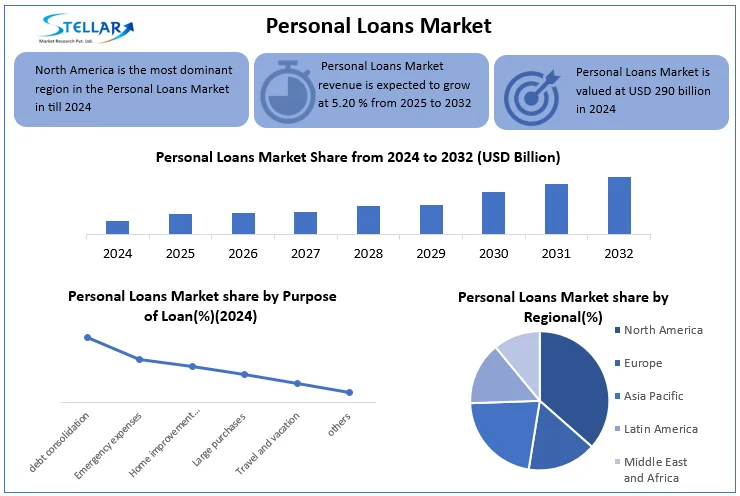

Personal Loans Market To Reach USD 435.03 Billion in 2032. CAGR is expected to be around 5.20% To Forecast 2025-2032

Personal Loans Market was estimated at USD 290 billion in 2024 and is expected to reach USD 435.03 billion in 2032. CAGR is expected to 5.20% 2025-2032.

Personal loans empower individuals by providing quick, flexible financial solutions, enabling dreams, managing emergencies, and fostering financial independence in an ever-evolving economy.”

WILMINGTON, DE, UNITED STATES, August 22, 2025 /EINPresswire.com/ -- Stellar Market Research examines the growth rate of the Personal Loans Market during the forecasted period 2025-2032— Navneet Kaur

The Personal Loans Market is projected to grow at a CAGR of approximately 5.20% over the forecast period. The Personal Loans Market was valued at USD 290 billion in 2024 and is expected to reach USD 435.03 billion by 2032. The rise in personal loans comes from online tech, better pay, more people getting to use financial services, easy use of phones, varied loan choices, rules help, and using them to pay off debts and sort out money better.

Personal Loans Market Overview

The personal loans market is getting big fast all over the world, helped by more people wanting easy credit to pay for school, health care, trips, and paying off debt. New tech like AI that helps score credit and online sites make getting a loan easy and open up access. More money and work to get everyone into banking are making more people able to borrow, mostly in new markets. Good rules, lending from one person to another, and loans made just to help more people get into the market. In all, this area aims for quick, easy, and custom loans that help the buyer and promote safe borrowing.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/personal-loans-market/2753

Personal Loans Market Dynamics

Drivers

Rising Disposable Income and Consumer Spending

As money grows due to strong economies in both new and old markets, people borrow more for life, school, and health needs. Even with rising prices and flat wages hitting real earnings, many still seek bigger personal loans. Fintech and non-bank companies make it easier to get loans, as lenders change to meet new needs. This shapes a lively and growing market for personal loans, even as people plan their money with care.

Financial Inclusion and Government Initiatives

All over the world, governments set up plans like India's Jan Dhan Yojana to help more people use banks and get loans. They use digital IDs to make it easy for folks to get formal loans, and rules make sure loans are fair and clear. These steps help build trust with people, bring more into the borrowing group, and make cheaper loans for those with less or mid-level money. This lifts financial power for many.

Growing Need for Debt Consolidation and Financial Management

More people owe money, so they ask for personal loans to put high-cost debts like credit cards into easier, cheaper loans. Better money sense helps them get better credit scores and lower their costs. Online loan sites make it simple to join these debts, making it easy to reach. All over the world, higher debt and money issues push this trend, changing personal loans into the main way to handle money and stay stable.

Restrain

High Interest Rates

Personal loans have high rates since they lack security, making them more costly, mainly for folks with okay or bad credit. Recent rate jumps with rising prices have pushed rates high all around, making loans less easy to get and slowing down market growth. Lenders cut back on credit to handle risk. Meanwhile, new tech in finance uses AI to give better rates and open up access to more people who can pay back.

Innovations and Developments

Technological innovation is a key factor propelling the Personal Loans Market forward. Notable advancements include:

Digital Lending Platforms and Mobile Apps: More and more, full digital sites let people ask for, get, and look after personal loans all online or on phone apps. This cuts down on paper, makes process times short, and makes it better how clients to feel with quick choices and money handouts.

Open Banking Integration: Open banking APIs let loan givers reach into real-time money info from customers’ bank accounts (if they say yes), making it easy to see risks right and give loans that fit the person well.

Personal Loans Market Segmentation

By Loan Type

By Loan Type, the Personal Loans Market is further segmented into Secured Loans, Unsecured Loans, Debt Consolidation Loans, and Personal Lines of Credit. Unsecured personal loans are on top because they need no backup, have free use, and get quick yeses. New tech and more want from young people drive up growth. After the sickness, unsecured loans jumped up around the world. Markets grew with changing rules, making this part the fastest-growing and biggest in the personal loans industry.

Personal Loans Market Regional Analysis

North America: North America tops the personal loans market because it has a strong money network, high use of credit by people, new tech in finance, good money know-how, and rules that help. More needs after the virus and the rise of online loans make its lead in the market even bigger.

Asia-Pacific: Asia-Pacific is second-best in personal loans because of fast money growth, a growing middle class, more use of digital and mobile tech, government plans for financial reach, new fintech ideas, and a large number of people. This leads to a high need and quick market growth in the area.

Europe: Europe sits third in the personal loans market. This happens because of high-end banks, tough rules, fintech rise, and more digital lending. Main groups, such as Klarna and Revolut, push new ideas as the market keeps growing.

To know the most attractive segments, click here for a free sample of the report: https://www.stellarmr.com/report/req_sample/personal-loans-market/2753

Recent Developments:

In May 2025, Piramal Enterprises teamed up with Piramal Finance to work better. In April 2025, Piramal Finance and ICICI Bank came together to give joint loans to people living in the countryside and towns near cities.

In June 2024, Fibe got $90 million from a Series E funding event. In April 2025, the firm worked with Mirae Asset Financial Services to give personal loans to working people in India.

Personal Loans Market Competitive Landscape

The global and regional players in the Personal Loans Market concentrate on developing and enhancing their capabilities, resulting in fierce competition. Notable players include:

SoFi (USA)

LendingClub (USA)

JPMorgan Chase (USA)

Discover (USA)

Fairstone Financial (Canada)

LightStream (USA)

HSBC (UK)

Barclays (UK)

BNP Paribas (France)

Deutsche Bank (Germany)

Related Reports:

Hair and Scalp Care Market: https://www.stellarmr.com/report/hair-and-scalp-care-market/2779

Travel Accommodation Market: https://www.stellarmr.com/report/travel-accommodation-market/2754

Cut Flower Market: https://www.stellarmr.com/report/cut-flower-market/2748

Mold Remediation Service Market: https://www.stellarmr.com/report/mold-removal-services-market/2739

Hydration Backpack Market: https://www.stellarmr.com/report/hydration-backpack-market/2735

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

sales@stellarmr.com

Lumawant Godage

Stellar Market Research

+ +91 9607365656

email us here

Visit us on social media:

LinkedIn

Instagram

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.